BioLineRx Reports Third Quarter 2012 Financial Results

Jerusalem, Israel – November 14, 2012 – BioLineRx Ltd. (NASDAQ: BLRX ; TASE: BLRX), a biopharmaceutical development company, today reported its results for the third quarter ending September 30, 2012.

Highlights of the Third Quarter of 2012 and Recent Developments:

- BL-1020 (Schizophrenia):

- Re-analysis of the Phase IIb EAGLE trial results indicates that BL-1020 demonstrated a significantly greater beneficial effect on cognitive function in schizophrenia patients compared to the original analysis of the study

- Announced the decision to conduct an interim analysis of Phase II/III CLARITY clinical trial, with results expected in Q1 2013

- Results from the Phase IIb EAGLE clinical trial, showing that BL-1020 is safe and effective in improving schizophrenia in addition to improving cognitive impairment, were published in the Journal of Clinical Psychiatry

- New U.S. patent on BL-1020, extending patent protection until at least 2031; additional European patent granted for BL-1020, valid through June 2026

- BL-8040 (Leukemia and other hematological cancers):

- Signed a worldwide exclusive license agreement with Biokine Therapeutics Ltd., a Clal Biotechnology Industries (TASE: CBI) portfolio company, to develop and commercialize BL-8040

- Phase IIa clinical studies for acute myeloid leukemia (AML) and acute lymphoblastic leukemia (ALL) expected to start in H1 2013

- BL-8020 (Hepatitis C):

- Successful completion of pre-clinical development for BL-8020, an oral, interferon-free treatment for Hepatitis C

- Phase I/II clinical study expected to commence in Q1 2013

- BL-7010 (Celiac disease):

- New pre-clinical results, demonstrating the safety of BL-7010, an oral treatment for celiac disease and gluten sensitivity, were presented at a leading European celiac conference

- Efficacy results published in Gastroenterology, a leading medical magazine

Kinneret Savitsky, Ph.D., CEO of BioLineRx, remarked, “We are pleased with the progress achieved in our portfolio during the third quarter with respect to our clinical and pre-clinical therapeutic compounds. With regard to our leading compound, BL-1020 for schizophrenia, we are especially excited by the recent re-analysis of the Phase IIb EAGLE study by an outside group of leading scientists. According to the re-analysis, when taking into account the effects of the circadian rhythm (i.e., 24-hour time cycle), BL-1020 is significantly more effective in improving cognitive function than previously discovered. The ramifications of this re-analysis have been taken into account in the execution of the on-going CLARITY Phase II/III trial for BL-1020, and these findings, along with other analyses we have previously performed, have motivated us to initiate an interim analysis of the short-term cognitive effects of BL-1020 within the CLARITY trial. We are hopeful the interim analysis will reinforce our confidence regarding the cognitive benefits of BL-1020, and potentially accelerate our commercialization efforts for the further development of this promising therapeutic candidate.”

Dr. Savitsky added, “Following our strategic decision to enter the field of oncology, we were extremely fortunate during the quarter to in-license BL-8040, a promising Phase II ready drug for the treatment of acute myeloid leukemia (AML), acute lymphoblastic leukemia (ALL), as well as other types of hematological cancers. Since AML and ALL are recognized orphan indications, we plan to seek orphan designation status from the regulatory authorities in order to accelerate BL-8040’s development plan. In addition, based on BL-8040’s positive pre-clinical data, as well as its mechanism of action, we believe it can be utilized for several other related oncology indications. We look forward to the upcoming Phase II clinical studies for evaluating BL-8040’s efficacy on AML and ALL patients, which are expected to commence in the first half of 2013. This compound has recently attracted the attention of leading physicians and scientists at the MD Anderson Cancer Center in Houston, Texas, one of the premier cancer centers in the world. We expect the MD Anderson Cancer Center to be the lead site in the upcoming clinical studies.”

“An important milestone achieved during the third quarter was the successful completion of the pre-clinical stage of development for BL-8020, an orally available, interferon-free treatment for Hepatitis C. We are proud of the speed and efficiency demonstrated in advancing BL-8020 to the clinical stage, in light of the fact that we just in-licensed this compound during the first quarter of this year. BL-8020 works on the host rather than directly on the virus itself, which suggests pan-genotypic efficacy and the ability to be combined with different drug groups. These two characteristics make BL-8020 attractive as an adjunct therapy to other oral cocktail therapies, therefore not directly competing with the crowded HCV market of currently approved therapies or those under development. We look forward to commencing a Phase I/II clinical study for this promising drug at the beginning of 2013,” stated Dr. Savitsky.

Dr. Savitsky concluded, “So far, 2012 has been a year of substantial achievement for BioLineRx. We have enjoyed increased awareness among the investment community as two analysts have initiated coverage of the Company. Additionally, we made significant progress on multiple fronts, many of which are expected to come to key value inflection points in the near future. The coming months are expected to be eventful, as we receive the interim results of BL-1020’s CLARITY Phase II/III trial, results of the Phase II clinical trial of BL-7040 for the treatment of inflammatory bowel disease, as well as commence clinical trials for BL-8020 for the treatment of HCV, and BL-8040 for the treatment of leukemia. We have had a busy and productive quarter and believe these critical milestones showcase the strength of our business model and the competence of our highly experienced team.”

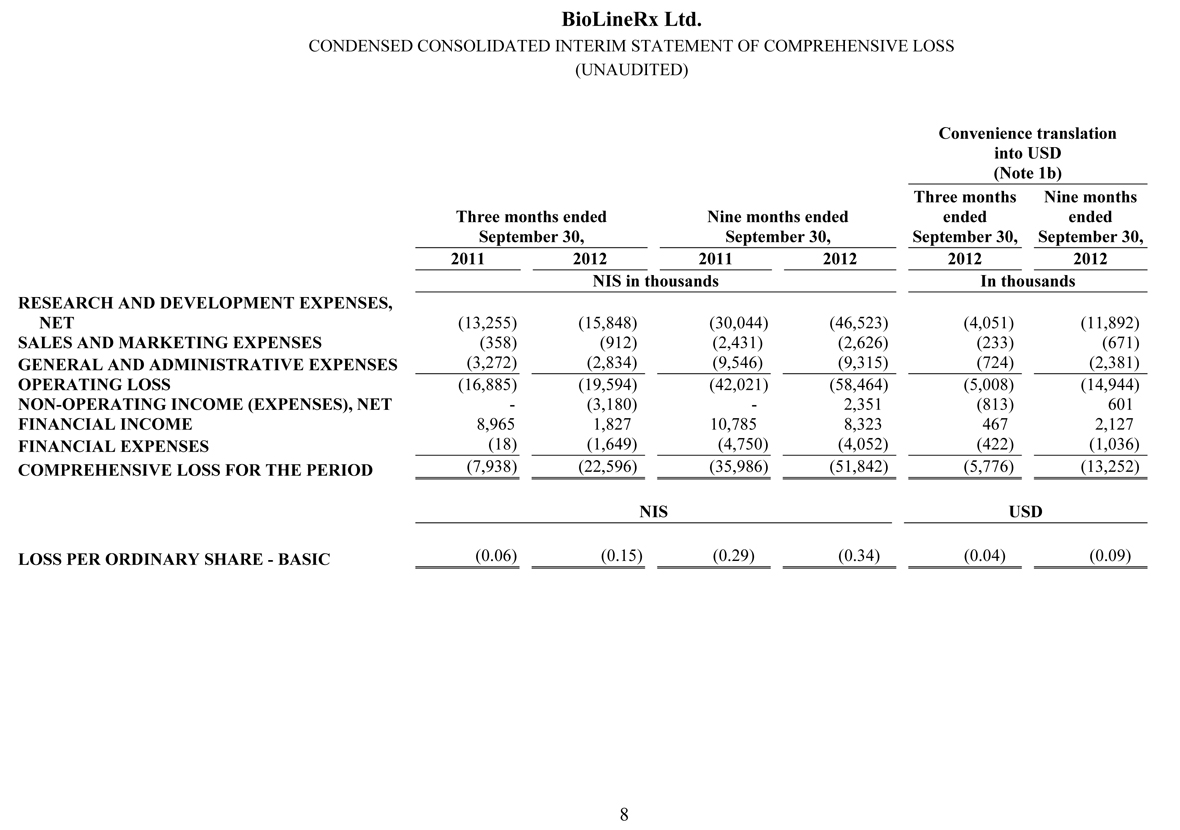

Financial Results for Three Months and Nine Months Ending September 30, 2012

During the three and nine months ended September 30, 2012 and 2011, no revenues were recorded.

Research and development expenses for the quarter ended September 30, 2012 were NIS 15.8 million ($4.1 million), an increase of NIS 2.6 million ($0.7 million), or 20%, compared to NIS 13.2 million ($3.4 million) for the quarter ended September 30, 2011. The increase resulted primarily from higher expenses in 2012 associated with the CLARITY clinical trial in respect of BL-1020, which commenced at the end of June 2011 and was still in its initial stages during the third quarter of 2011. Research and development expenses for the nine months ended September 30, 2012 were NIS 46.5 million ($11.9 million), an increase of NIS 16.5 million ($4.2 million), or 55%, compared to NIS 30.0 million ($7.7 million) for the nine months ended September 30, 2011. The increase resulted primarily from higher expenses in 2012 associated with the CLARITY clinical, as mentioned above in the three-month comparison, as well as a ramp-up in spending on several new projects introduced during the second half of 2011 and the first nine months of 2012.

Sales and marketing expenses for the quarter ended September 30, 2012 were NIS 0.9 million ($0.2 million), an increase of NIS 0.5 million ($0.1 million), or 155%, compared to NIS 0.4 million ($0.1 million) for the quarter ended September 30, 2011. The increase relates to professional fees and other expenses stemming from a significant increase in our business development efforts, compared to the third quarter of last year. Sales and marketing expenses for the nine months ended September 30, 2012 were NIS 2.6 million ($0.7 million), an increase of NIS 0.2 million ($0.1 million), or 8%, compared to NIS 2.4 million ($0.6 million) for the nine months ended September 30, 2011. The increase relates to a significant increase in our business development efforts over the last year, offset by savings resulting primarily from efficiencies realized this year due to the reorganization of our business development team, as well as professional services incurred in the nine-month period last year related to the reacquisition of the rights to BL-1020 from Cypress Bioscience.

General and administrative expenses for the quarter ended September 30, 2012 were NIS 2.8 million ($0.7 million), a decrease of NIS 0.4 million ($0.1 million), or 13%, compared to NIS 3.2 million ($0.8 million) for the quarter ended September 30, 2011. The decrease resulted primarily from a one-time expense for professional services incurred in the three-month period last year associated with the Company’s initial listing on NASDAQ in July 2011. General and administrative expenses for the nine months ended September 30, 2012 were NIS 9.3 million ($2.4 million), a decrease of NIS 0.2 million ($0.1 million), or 2%, compared to NIS 9.5 million ($2.5 million) for the nine months ended September 30, 2011. The reasons for the decrease are similar to those discussed above in the three-month comparison, partially offset by an increase in investor relations efforts made during the 2012 period.

The Company’s operating loss for the quarter ended September 30, 2012 amounted to NIS 19.6 million ($5.0 million), compared with an operating loss of NIS 16.9 million ($4.3 million) for the quarter ended September 30, 2011. The Company’s operating loss for the nine months ended September 30, 2012 amounted to NIS 58.5 million ($14.9 million), compared with an operating loss of NIS 42.0 million ($10.7 million) for the comparable period in 2011.

Non-operating expenses for the quarter ended September 30, 2012 primarily result from a NIS 1.2 million ($0.3 million) fair-value adjustment of derivative liabilities on account of the warrants issued in the private placement which we conducted in February 2012, as well as initial commitment and finder’s fees in the aggregate amount of NIS 2.0 million ($0.5 million) relating to the share purchase agreement with LPC signed in September 2012. Non-operating income for the nine months ended September 30, 2012 primarily results from a NIS 5.5 million ($1.4 million) fair-value adjustment of derivative liabilities on account of the warrants issued in the private placement which we conducted in February 2012, offset by issuance expenses in the amount of NIS 1.2 million ($0.3 million) from the private placement related to the warrants, as well as the initial commitment and finder’s fees mentioned in the three-month comparison above.

Net financial income was NIS 0.2 million ($0.1 million) for the quarter ended September 30, 2012, a change of NIS 8.8 million ($2.2 million), compared to net financial income of NIS 8.9 million ($2.3 million) for the quarter ended September 30, 2011. Net financial income for the quarter ended September 30, 2011 results primarily from a significant increase in the average exchange rate of the dollar in relation to the NIS during the period, which had a positive effect on net assets denominated in dollars. Net financial income was NIS 4.3 million ($1.1 million) for the nine months ended September 30, 2012, a change of NIS 1.7 million ($0.4 million), compared to net financial income of NIS 6.0 million ($1.5 million) for the nine months ended September 30, 2011. Net financial income for both nine-month periods result primarily from increases in the average exchange rate of the dollar in relation to the NIS, which had a positive effect on net assets denominated in dollars.

Net loss for the quarter ended September 30, 2012 amounted to NIS 22.6 million ($5.8 million), compared with a net loss of NIS 7.9 million ($2.0 million) for the quarter ended September 30, 2011. Net loss for the nine months ended September 30, 2012 amounted to NIS 51.8 million ($13.3 million), compared with a net loss of NIS 36.0 million ($9.2 million) for the comparable period in 2011.

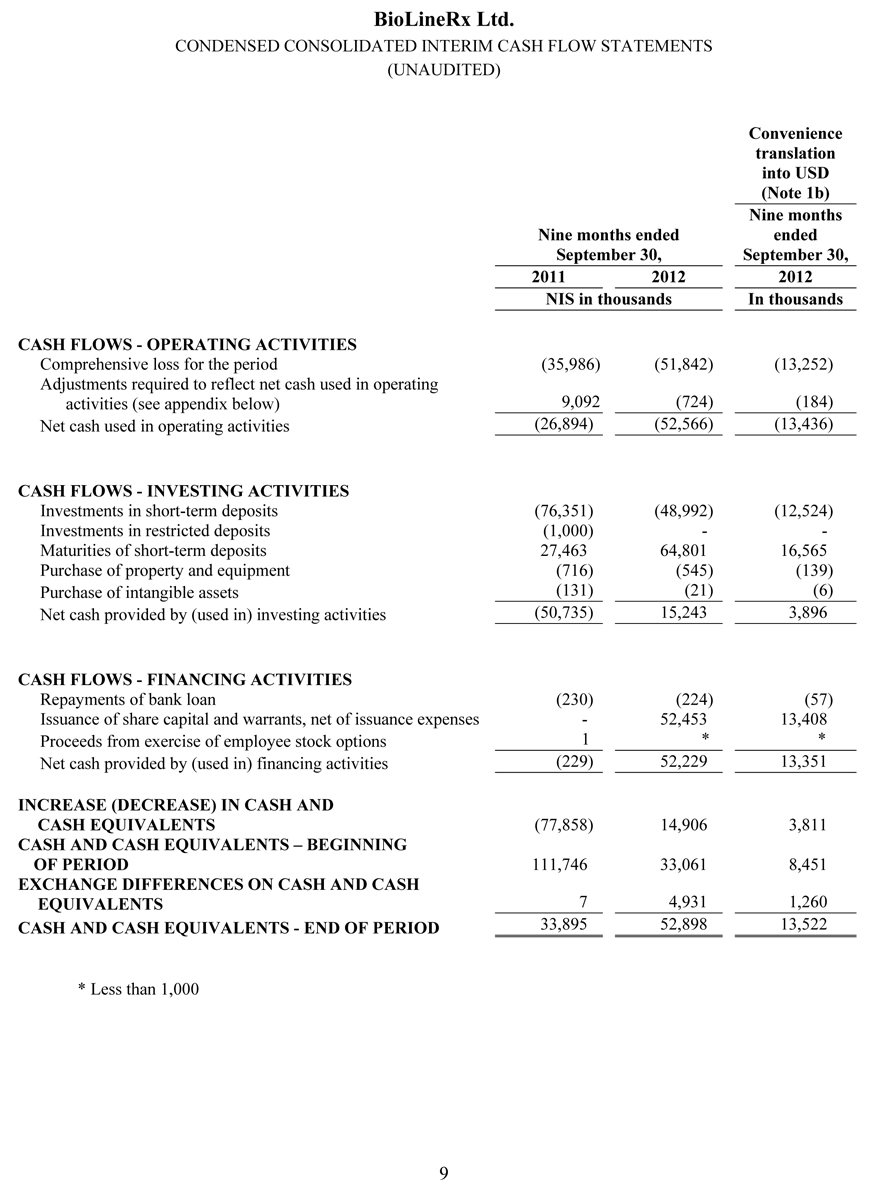

As of September 30, 2012, BioLineRx had NIS 101.1 million ($25.9 million) in cash, cash equivalents and short-term bank deposits, compared with NIS 98.8 million ($25.2 million) as of December 31, 2011. The increase in cash, cash equivalents and short-term deposits is mainly due to the private placement completed in February 2012, less cash outflows for the Company’s operating activities during the period.

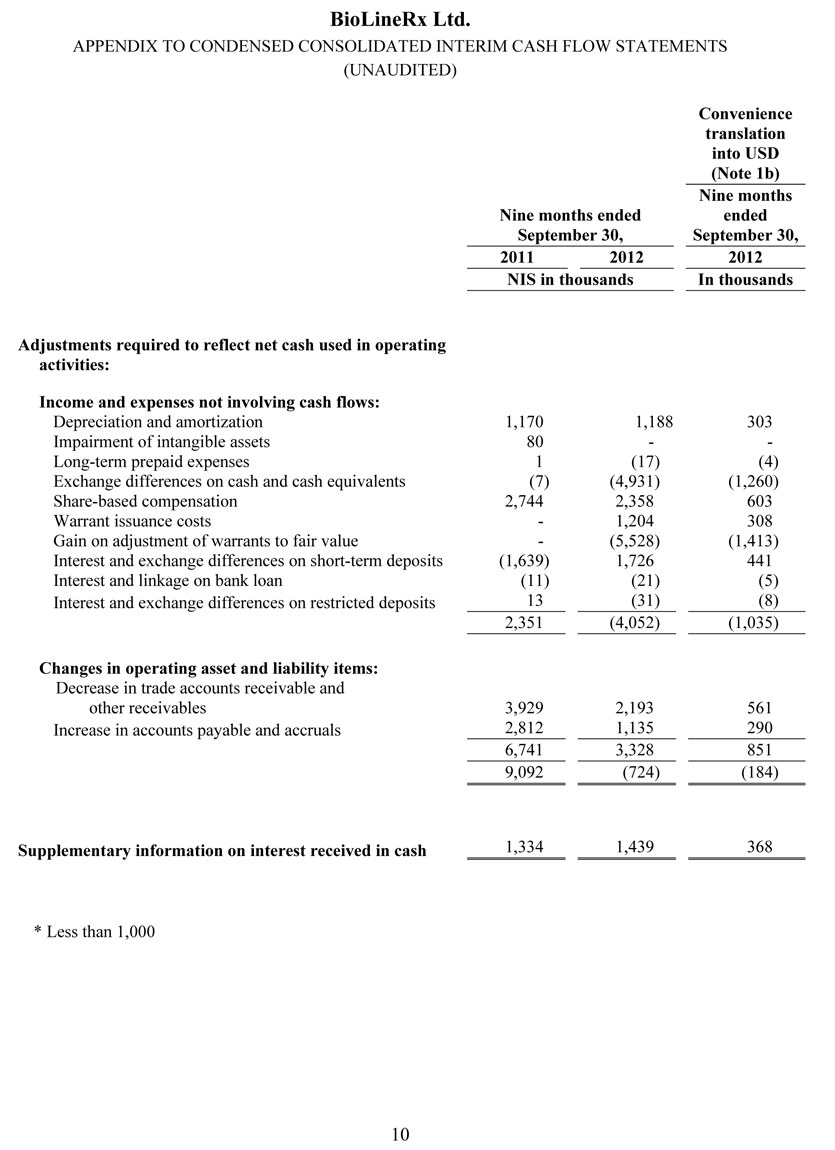

Net cash used in operating activities was NIS 52.6 million ($13.4 million) for the nine months ended September 30, 2012, compared with net cash used in operating activities of NIS 26.9 million ($6.9 million) for the nine months ended September 30, 2011. The NIS 25.7 million ($6.5 million) increase in net cash used in operating activities during the nine-month period in 2012, compared to the nine-month period in 2011, was primarily the result of increased research and development spending.

Net cash provided by investing activities for the nine months ended September 30, 2012 was NIS 15.2 million ($3.9 million), compared to net cash used in investing activities of NIS 50.7 million ($13.0 million) for the nine months ended September 30, 2011. The cash flows provided by investing activities in the 2012 period relate primarily to a net decrease in the amount of short-term bank deposits during the period. The cash flows used in investing activities in the 2011 period relate primarily to a net increase in the amount of short-term bank deposits during the period.

Net cash provided by financing activities for the nine months ended September 30, 2012 was NIS 52.2 million ($13.4 million), compared to an insignificant amount of net cash used in financing activities for the nine months ended September 30, 2011. This increase relates to the private placement completed in February 2012.

Conference Call and Webcast Information

BioLineRx will hold a conference call to discuss its third quarter 2012 results today, November 14, 2012, at 9:00 a.m. EDT. To access the conference call, please dial 1-888-407-2553 from the U.S. or +972-3-918-0610 internationally. The call will also be available via live webcast through BioLineRx’s website. A replay of the conference call will be available approximately two hours after completion of the live conference call. To access the replay, please dial 1-877-456-0009 from the U.S. or +972-3-9255925 internationally. The replay will be available through November 17, 2012.

(Tables follow)

About BioLineRx

BioLineRx is a publicly-traded biopharmaceutical development company. BioLineRx is dedicated to building a portfolio of products for unmet medical needs or with advantages over currently available therapies. BioLineRx’s current portfolio consists of six clinical stage candidates: BL-1020 for schizophrenia is currently undergoing a Phase II/III study; BL-1040, for prevention of pathological cardiac remodeling following a myocardial infarction, which has been out-licensed to Ikaria Inc., is currently undergoing a pivotal CE-Mark registration trial; BL-5010 for non-surgical removal of skin lesions has completed a Phase I/II study; BL-1021 for neuropathic pain is in Phase I development, BL-7040 for treating inflammatory bowel disease (IBD) is currently undergoing a Phase II trial, and BL-8040 for treating acute myeloid leukemia (AML) and other hematological cancers has completed Phase I. In addition, BioLineRx has eight products in various pre-clinical development stages for a variety of indications, including central nervous system diseases, infectious diseases, cardiovascular and autoimmune diseases.

BioLineRx’s business model is based on acquiring molecules mainly from biotechnological incubators and academic institutions. The Company performs feasibility assessment studies and development through pre-clinical and clinical stages, with partial funding from the Israeli Government’s Office of the Chief Scientist (OCS). The final stage includes partnering with medium and large pharmaceutical companies for advanced clinical development (Phase 3) and commercialization. For more information on BioLineRx, please visit www.biolinerx.com.

Various statements in this release concerning BioLineRx’s future expectations, plans and prospects, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include words such as “may,” “expects,” “anticipates,” “believes,” and “intends,” and describe opinions about future events. These forward-looking statements involve known and unknown risks and uncertainties that may cause the actual results, performance or achievements of BioLineRx to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Some of these risks are: changes in relationships with collaborators; the impact of competitive products and technological changes; risks relating to the development of new products; and the ability to implement technological improvements. These and other factors are more fully discussed in the “Risk Factors” section of BioLineRx’s Form 20-F filed with the Securities and Exchange Commission on March 22, 2012. In addition, any forward-looking statements represent BioLineRx’s views only as of the date of this release and should not be relied upon as representing its views as of any subsequent date. BioLineRx does not assume any obligation to update any forward-looking statements unless required by law.

Contact:

KCSA Strategic Communications

Garth Russell, 1-212-896-1250

grussell@kcsa.com

or

Todd Fromer, 1-212-896-1215

tfromer@kcsa.com

or

Tsipi Haitovsky, Public Relations

+972-3-6240871

tsipih@netvision.net.il